Mutual Funds

Mutual funds, in a simple way, are basically money pooled in by a large number of people to create fund and fund is managed or invested by professional experts. Investing in mutual funds lets you stay relax at home and let professionals manage your investments.

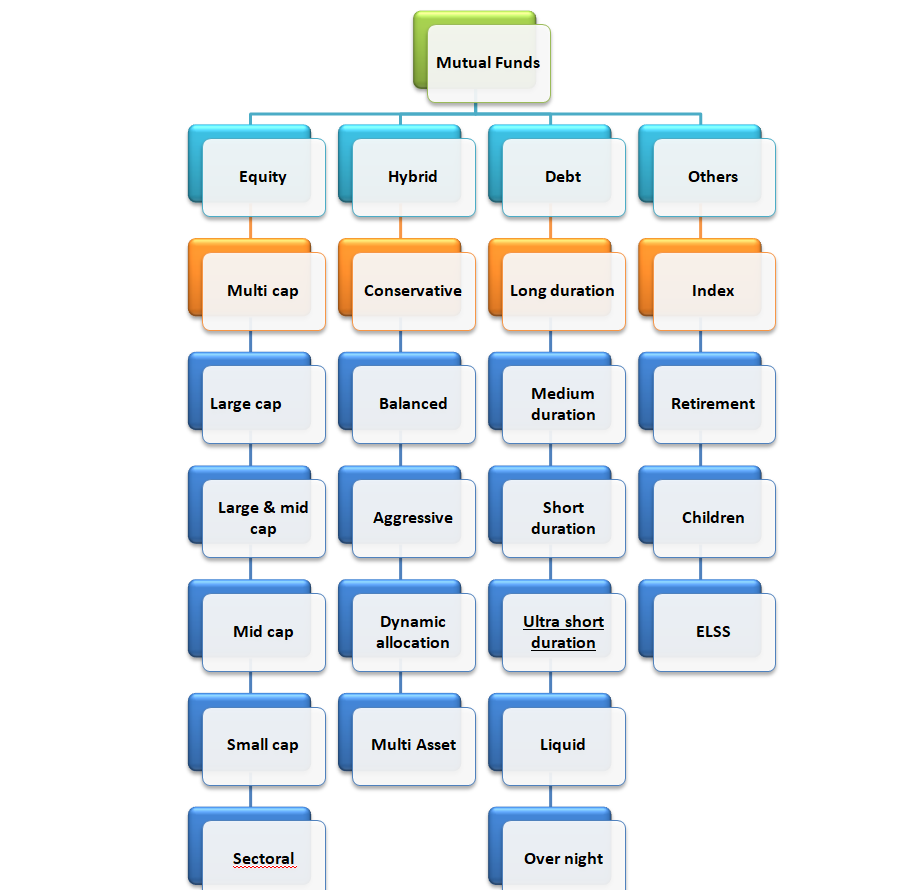

There are different types of mutual funds available in the market based on the risk and return. Higher the risk, higher the return. Details about the major categories are as under:

Equity Mutual Funds

Equity mutual funds are investment vehicles that specialize in allocating their assets primarily to stocks or equities of publicly traded companies. Managed by seasoned portfolio managers, these funds offer investors a diversified exposure to the stock market. Through pooling funds from multiple investors, equity mutual funds aim to generate capital appreciation over the long term. They achieve this by carefully selecting a diversified portfolio of stocks across various sectors and industries.

Equity mutual funds are characterized by their potential for higher returns compared to fixed-income funds, albeit with higher associated risks. Professional management is a key feature, with portfolio managers conducting thorough market analysis and fundamental research to make informed investment decisions.

Investors have the flexibility to choose from various types of equity funds, including growth, value, and blend funds, catering to different investment objectives and risk appetites. Liquidity is another advantage, with investors able to buy or sell shares of equity mutual funds on any business day at the fund’s net asset value (NAV).

However, it’s important for investors to carefully consider fees, expenses, and past performance when selecting equity mutual funds that align with their financial goals and risk tolerance.

Hybrid Mutual Funds

Hybrid mutual funds, also known as balanced funds, offer investors a diversified investment solution by combining various asset classes within a single portfolio. Unlike funds that solely focus on stocks or bonds, hybrid funds allocate their assets across equities, fixed-income securities, and sometimes other instruments like cash equivalents or alternative investments. This diversified approach aims to strike a balance between growth potential and risk management.

With predetermined asset allocation strategies, hybrid funds cater to different investment objectives, whether it’s capital preservation, income generation, or capital appreciation. Professional portfolio managers actively oversee these funds, making strategic decisions based on market conditions and the fund’s objectives.

Hybrid mutual funds provide investors with the flexibility to access multiple asset classes through a single investment vehicle. This accessibility, coupled with the potential for steady returns and risk mitigation, makes them suitable for a wide range of investors, from those seeking income to those pursuing long-term growth.

Investors should consider factors such as expense ratios, performance history, and the fund’s investment approach when evaluating hybrid mutual funds. By doing so, investors can make informed decisions that align with their financial goals and risk tolerance. Overall, hybrid mutual funds offer a convenient and diversified way for investors to achieve their investment objectives.

Debt Mutual Funds

Debt mutual funds are investment options that primarily focus on fixed-income securities like government and corporate bonds. Managed by professionals, they aim to provide stable returns and income through interest payments. Offering diversification and liquidity, these funds cater to investors seeking capital preservation and regular income. With various categories available, investors can choose funds aligned with their risk tolerance and financial goals, making debt mutual funds a flexible and accessible investment choice.

Other Mutual Funds

there exist several other types of mutual funds tailored to specific investment goals and strategies. Here are a few examples:

- Index Funds: These funds aim to replicate the performance of a specific market index, such as the S&P 500 or the FTSE 100, by holding a portfolio of securities that mirrors the index’s composition.

- Money Market Funds: Money market funds invest in short-term, low-risk securities such as Treasury bills, certificates of deposit, and commercial paper. They offer stability of principal and liquidity, making them popular choices for investors seeking capital preservation and short-term cash management.

- Sector Funds: Sector funds focus on specific sectors or industries of the economy, such as technology, healthcare, energy, or consumer goods. Investors can target their investments based on their views on particular sectors or capitalize on sector-specific trends.

- International/Global Funds: These funds invest in stocks and bonds of companies located outside the investor’s home country. International funds focus on specific regions or countries, while global funds invest across multiple countries, providing exposure to international markets and diversification benefits.

- Specialty Funds: Specialty funds concentrate on specific investment themes or strategies, such as socially responsible investing (SRI), real estate, commodities, infrastructure, or emerging markets. These funds cater to investors interested in specific asset classes or investment themes.