What is Share Buyback?

Category : Investment , Long term investment

The Buyback is a process in which a company repurchases its own shares from its existing shareholders, which reduces outstanding shares in the market. Company buybacks the shares from its interested shareholders by offering them cash. Buyback can be done either through a tender offer route or open market route.

Tender offer

In this offer Shareholders are presented with a tender offer whereby they have the option to submit all of their shares or the portion of shares within a certain time period and at a premium to the current market price. Here the buy back price and duration are predefined.

Open market

Companies buy back shares upto certain number not necessarily the complete declared quantity on the open market over an extended period of time. Here the maximum price is fixed and the buyback can be done up to or below that particular price, not beyond.

Reasons of buyback

Excess cash

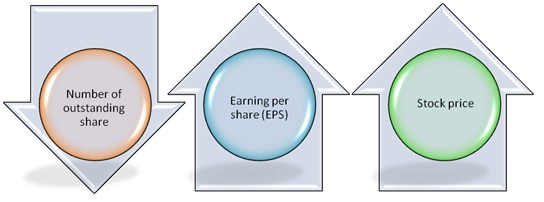

Companies that have excess cash available with them, with no plans for investment or any deployment requirements for the same, may consider buybacks, which reduces the number of outstanding shares in the market hence improves the earnings per share for existing shareholders.

Example showing the effect on EPS

Example:- Let assume a Company ABC has one million shares (10,00,000) held with its shareholder.Company had earnings of Rs 10,00,000/- last year.

So, EPS (Earning per share = total earning/total number of outstanding shares) = Rs 1.0

*If the company buybacks 20% of its outstanding shares at its current market price and if the P/E=50, the shares are traded at Rs 50.0

Outstanding shares left after buyback = (10,00,000-2,00,000)=8,00,000

EPS after Buyback = (1000,000/8,00,000)= Rs 1.25

Undervaluation

Another reason when the company feels to buy back its shares is, when its shares are undervalued means the current share price does not reflect its true value. Thus Company buybacks the shares which increases its EPS and the share price. It can be explained better with below example –

EPS after buyback =1.25

P/E =50 as stated above

Market price= (EPS*P/E) so 1.25*50 = Rs 62.5

Thus shares would trade up now at= Rs 62.5/-

Avoid takeover threats

Buyback is also used by the company to avoid any takeover threats by increasing promoter holding. A takeover occurs when one company tries to acquire another company by acquiring its maximum shares to have a majority stake in the company. When the company buybacks its shares, the outstanding shares in the market reduces which avoids any takeover threats by the shareholders who may be looking for controlling stake in the company.

Tax gains

Companies prefer Buyback to reward their investors than distributing dividend payout because dividend distribution tax is also paid by companies while distributing dividend to its shareholders. Thus Buyback is more tax efficient than dividend payout by the companies.