How does a SIP work?

Category : Investment , Long term investment

What is SIP?

SIP or Systematic Investment Plan is a plan through which a person can invest a small amount in a mutual fund at regular intervals say once a month or once a quarter, instead of making a lump-sum investment.

Invest Small Amount

SIPs can be started with a minimum of ₹500 each month. you can choose the frequency as monthly or quarterly for investing according to your choice.

Averages the purchase cost

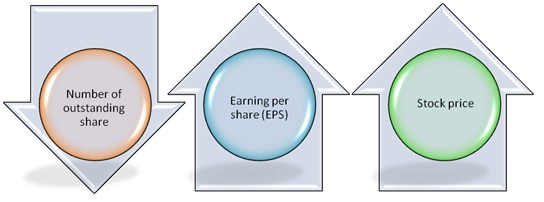

SIP make sure that you invest a fixed amount regularly over a period irrespective of the market conditions. you would get more units when the market falls and less units when the market rises .

This averages the purchase cost of your mutual fund units and places the investment in the position to earn good return.

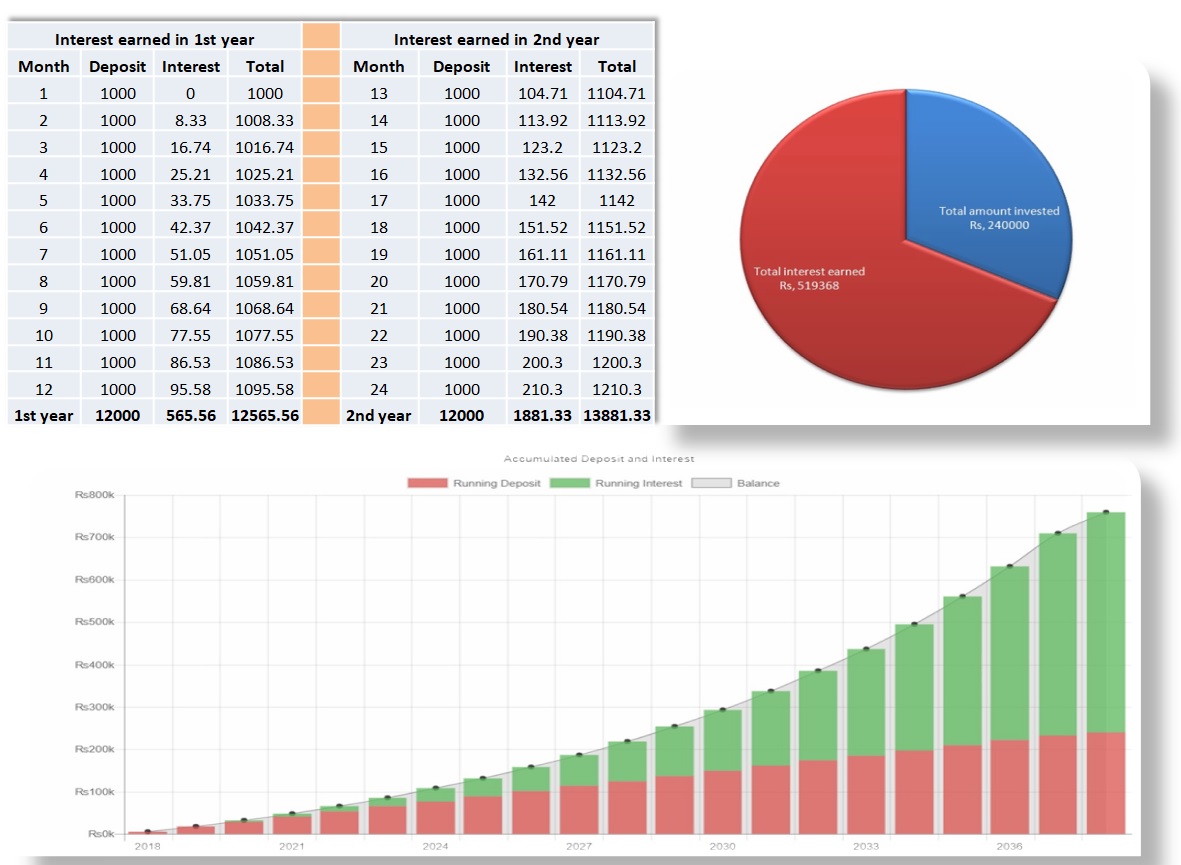

The compounding factor

The earlier you start investing, the more wealth you are able to create for yourself -and this is exactly what the power of compounding does for you.

Whatever sum of money you invest, you will earn interest on it. and, this interest also gets invested to earn interest. Thus, it helps in creating a substantial amount of wealth in the long run.

Achieve your goals

SIP helps to achieve your long-term financial goals as your investments are broken down into smaller, regular investments. Investing a small amount regularly helps you to achieve your long term goal.

Discipline yourself financially

SIP imparts discipline in the investment process, making you invest a fixed amount at regular intervals. By starting early, even with a small amount, you can build a big corpus over a period of time to achieve your financial goals.

How does a SIP work?

- Every month a fixed amount is deducted from the investor’s bank account and invested in the mutual fund scheme, chosen by the investor at the time of starting a SIP.

- Every time the amount is invested in the mutual fund scheme, units are allotted to the investor.

- Since investments are broken down into smaller, regular investments, your investments average out the market ups and downs and results in averaging your cost and maximizing your return.

- Investor can redeem (withdraw) units or switch to another schemes, whenever he wishes to do so. Investor should check the scheme related document as some mutual funds have a specified lock-in-period.