Power of compounding: Reason to invest

Tags : interestInvestmentsaving

Category : Investment , Long term investment

Everyone talks about the investment, why we should invest is still not clear to most of them.

So, what is compounding?

Compounding is the method of earning income from your previous earnings by reinvesting them. Lets understand this with a simple example:

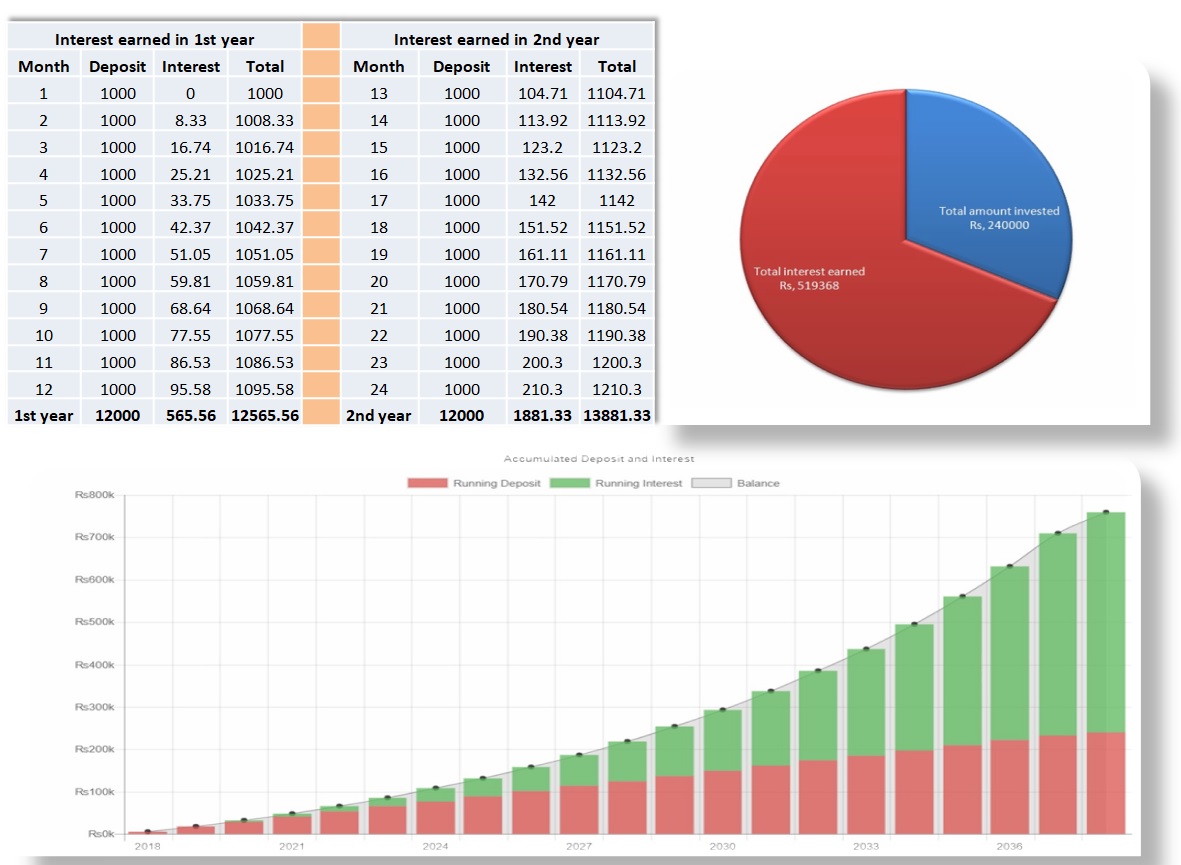

Let us assume that someone invested Rs 1000 per month for 20 years and if the expected rate of return is 10% per year. The interest for the first year would be Rs 565. In compounding, First year’s interest is added to the principal in the second year and so on. So, Second Year Principal will be =(12000+565)=12565 and interest will be Rs 1881.

For more detailed table and graphs, refer to Poonje’s SAVING CALCULATOR http://poonje.com/saving-calculator/

After 20 years, total amount invested will be Rs 240,000.00 and total interest earned will be Rs 519,368.00. If you look closely total interest earned is more than 2 times the amount invested. So, let me simply say this, put your money to work and let it earn more money for you.

Thus, we see that as the time goes, earnings do not multiplies but grows exponentially.

How to make best use of compounding (make your hard earn money to earn more money for you)

Start early

As seen in the above example, you were able to grow an investment of Rs 1000/- per month to nearly Rs 759,368 (invested amount Rs 240,000 and total interest earned Rs 519,368) in 20 years.

However, if you extended the investment horizon by another 5 years, you have earned much more Rs 1,326,833 (invested amount Rs 300,000 and total interest earned Rs 1,026,833).

Thus, the longer you hold more you gain from compounding effect. This is one of the primary reasons to start investing early.

Think before invest

Before investing, think about your investment objective, time period & your risk tolerance. After that choose the investment products that give you a higher rate of interest and meets your objective. Example investing in Fixed Deposit have low interest rate but little to no risk than Mutual funds. Investing in Equities has high return and high risk.

Invest regularly in order to grow your investment

By regularly increasing your investment amount, you can make a huge difference over the long term. Even regular investment helps you, budget your day to day life & restricts you from overspending.

The best way of making your money grow, is to stay diversified and keep investing steadily. If you invest a set amount regularly, you will automatically take advantage of volatility in the market and can grow your investment. Thus, the slow and steady approach tends to yield more growth and less stress.